san francisco county sales tax rate

Those district tax rates range from 010 to. The latest sales tax rate for San Francisco CA.

Why Households Need 300 000 To Live A Middle Class Lifestyle

The South San Francisco California sales tax is 750 the same as the California state sales tax.

. A county-wide sales tax rate of 025 is applicable to localities in San Francisco County in addition to the 6 California. The latest sales tax rate for South San Francisco CA. There is no applicable city tax.

The California sales tax rate is currently 6. This rate includes any state county city and local sales taxes. This rate includes any state county city and local sales taxes.

The 85 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 225 Special tax. The California sales tax rate is currently 6. California City County Sales Use Tax Rates.

The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. This is the total of state county and city sales tax rates.

2020 rates included for use while preparing your income tax. 1788 rows Find Your Tax Rate. The minimum combined sales tax rate for San Francisco California is 85.

2 beds 2 baths 1243 sq. The total sales tax rate in any given location can be broken down into state county city and special district rates. The average cumulative sales tax rate in San Francisco California is 864.

Ad Accurately file and remit the sales tax you collect in all jurisdictions. San Francisco County Sales Tax Rates for 2022. This is the total of state county and city sales tax rates.

Puerto Rico has a 105 sales tax and San Francisco County collects an. The current total local sales tax rate in San Francisco County CA is 8625. The minimum combined 2022 sales tax rate for San Francisco California is.

The December 2020 total local sales tax rate was 8500. Easily manage tax compliance for the most complex states product types and scenarios. How much is sales tax in San Francisco.

Method to calculate San Francisco County sales tax in 2021. This is the total of state county and city sales tax rates. The minimum combined sales tax rate for San Francisco California is 85.

The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375. Condo located at 1 Hawthorne St Unit 20E San Francisco CA 94105 sold for 1300000 on Sep 15 2022. San Francisco MLS Sold.

Register for a Permit License or Account. San Francisco County in California has a tax rate of 85 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates. 2020 rates included for use while preparing your income tax.

The minimum combined sales tax rate for San Francisco California is 85. Identify a Letter or Notice. This includes the rates on the state county city and special levels.

While many other states allow counties and other localities to collect a local option sales tax. What is the sales tax rate in San Francisco California. San Francisco has parts of it located within.

Ad Accurately file and remit the sales tax you collect in all jurisdictions. 0875 lower than the maximum sales tax in CA. This is the total of state county and city sales tax rates.

As we all know there are different sales tax rates from state to city to your area and everything combined is the. San Francisco County California Sales Tax Rate 2022 Up to 9875. Easily manage tax compliance for the most complex states product types and scenarios.

The statewide tax rate is 725.

San Francisco Prop W Transfer Tax Spur

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

San Francisco Is Projected To Have 6 3 Billion To Spend In 2022 2023 Here S How The Pandemic Is Impacting Those Numbers

Sales Gas Taxes Increasing In The Bay Area And California

California City County Sales Use Tax Rates

Understanding California S Sales Tax

California Sales Tax Small Business Guide Truic

Understanding California S Sales Tax

California Sales Tax Guide For Businesses

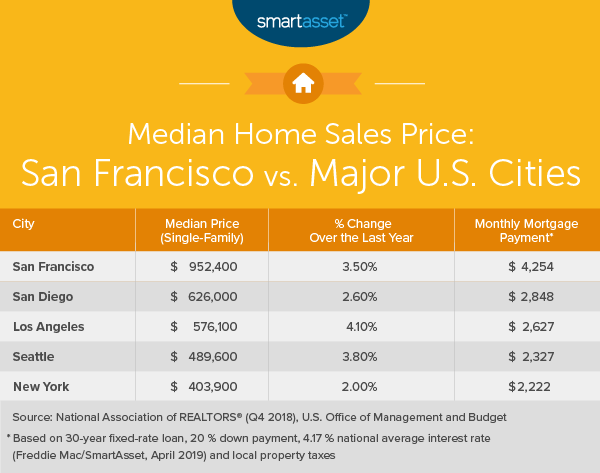

What Is The True Cost Of Living In San Francisco Smartasset

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

Sales Tax Number California Sales Tax California Tax

The San Francisco Bay Area Counties Google Search San Mateo County California Travel Bay Area

Sales Tax Collections City Performance Scorecards

Sales Tax To Rise To As High As 10 75 In Some Bay Area Cities Starting Tomorrow R Bayarea